37+ Retirement income tax calculator 2021

Enter your filing status income deductions and credits and we will estimate your total taxes. Use our retirement calculator to determine if you will have enough money to enjoy a happy and secure retirement.

Using Guard And Reserve Retirement Calculators To Estimate A Reserve Pension Retirement Calculator Retirement Guard

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. Our Retirement Calculator can help by considering inflation in several calculations. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Tax and NI Calculator for 202122 Tax Year This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of.

And is based on. For 2021 you can contribute up to 19500 up to 26000 if youre age 50 or older. In 2021 the maximum adjusted gross income after deducting 401 k or IRA contributions to be eligible for this program is 66000 for a married couple filing jointly 49500 for a head of.

You can also calculate your 2021 Return here. It is mainly intended for residents of the US. Based on your projected tax withholding for the year we can also estimate.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes. Our retirement calculator predicts how much you need to retire based on your current salary and investment dollars and divides it by your post-retirement years.

With income tax accounted for the returns rarely beat inflation. Available at participating offices and if your. Your retirement is on the horizon but how far away.

Between 25000 and 34000 you may have to pay income tax on. Referred client must have taxes prepared by 4102018. Thats not to say that there arent.

HR Block employees including Tax Professionals are excluded from participating. Based on your annual taxable income and filing status your tax bracket. Your household income location filing status and number of personal.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Enter your total 401k retirement contributions for 2021. Your 2021 taxable income - versus tax free income - will be taxed at different IRS income tax brackets or rates based on income tax brackets by.

Enter your IRA contributions for 2021.

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Templates

2

2

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

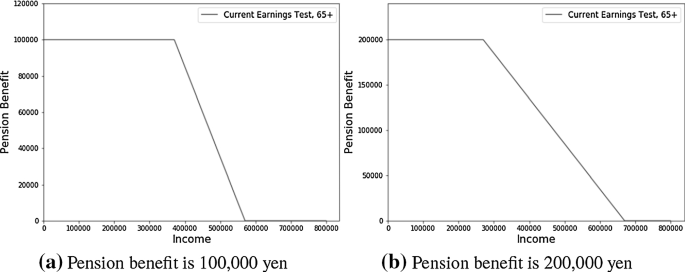

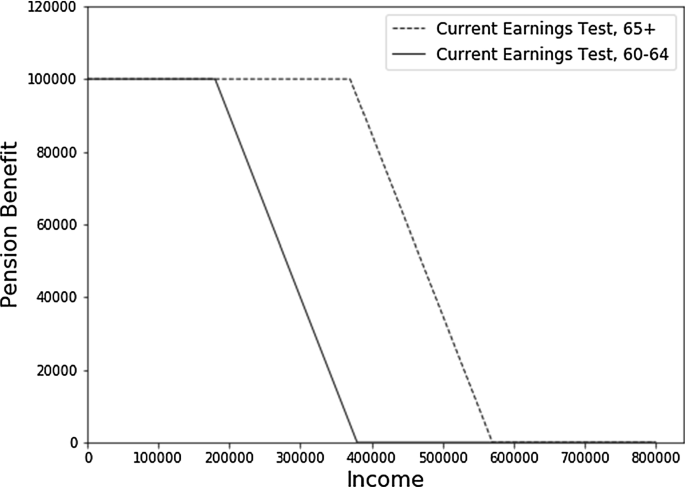

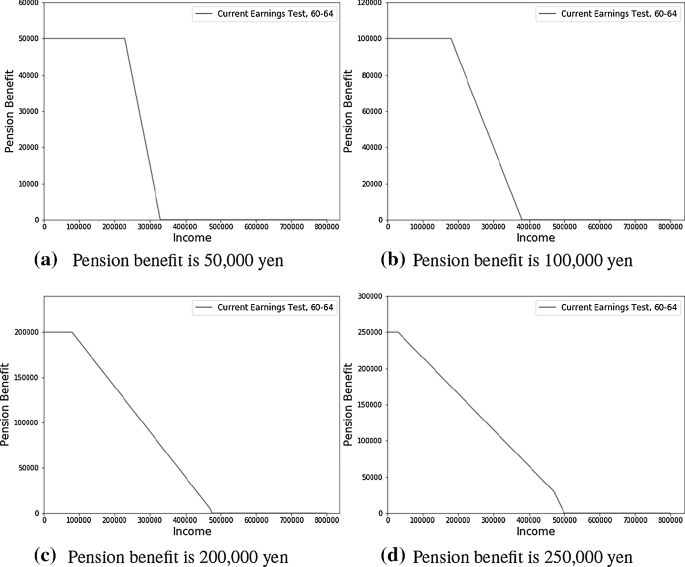

The Optimal Earnings Test And Retirement Behavior Springerlink

How The Government Pension Offset And Windfall Elimination Provision Affects Dually Entitled Spouses Social Security Intelligence

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

The Optimal Earnings Test And Retirement Behavior Springerlink

Five Tips To Maximize Your Tsp Savings Fedsmith Com

The Optimal Earnings Test And Retirement Behavior Springerlink

Ready To Use Employee Salary Sheet Excel Template India Msofficegeek Excel Templates Salary Tax Deducted At Source

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Online Broker

Calculating Spousal Benefits With Dual Entitlement Social Security Intelligence

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Form 1040 Income Tax Return Irs Tax Forms Income Tax

2